The development ideology of Navix Financial implies to provide it's own forex strategies/signals/analysis, which helps users to be able to gain the true knowledge of trading on their own and on the other side we made provision for users to utilize our investment opportunities where our experts trades for users and make a specific percentage(%) for them on daily, weekly or monthly basis as well, while they train and educate themselves with the system.

Our MISSION: Is to provide its users with effective ways of earning good returns from the forex market either through our educational system or our experts trading and making good returns on behalf of the users.OUR SYSTEM IS A SIMPLE DEFINITION OF LEARN AND EARN

Our GOALs: Is to provide quality learning opportunities to all users wanting to educate themselves in the forex market, this helps to produce independent students able to play a creative role in their community as well as in broader society. And as well to reach platform's capitalization value to 20Billion USD and grow it's users base to more than 15Million users by 2025. Navix Financial already uses the advantages of artificial intelligence software(A.I) to gain serious advantage and security over users funds in the forex market. This implementations allowed to significantly improve the accuracy of analytical data acquired used for development, set up and adjustments of algorithmic systems, and as well as generally improve the efficiency of platform operations.

The navix financial Blockchain will use distinctive cryptography that is resistant to

attacks,This groundbreaking approach aims to surpass the fundamental security weaknesses even if they are carried out with the use of quantum computing processing

power, and will allow avoiding the fundamental security weaknesses of the modern

cryptographic methods.

It is no secret that the future of the financial world lies within complete

digitalization of all financial processes, products and services. Navix Financial plans

on developing its own Digital Bank based on the navix financial Blockchain platform,

which will reduce the operational costs of the entire network and set new quality

standards for financial services.

Thanks to the functionality offered by navix financial socio-economic platform, private clients and businesses from any part of the world will be able to maintain transparent terms of cooperation with business partners, and ensure profitability of transactions for the sale and purchase of businesses, goods and services. The platform will allow digitalization of business processes, and also offer decentralized public voting for state, commercial and social management institutions.

There are many benefits and advantages of trading forex. Besides being the most traded

financial market in the world, unlike the stock market, the forex market is open 24

hours a day, 5 days a week, from Monday through to Friday.

This provides a great

opportunity for traders to trade at any time of the day or night.

For traders, in general the best potential trading opportunities can be those related to

the major currencies because they are traded more frequently, and therefore can be more

liquid. For many traders, the best time to trade is when the market is most active.

Exchange-traded funds (ETFs) make investing easier because they are the perfect product to

quickly build a diversified portfolio. We offer a wide range of ETFs trading on 19 major

exchanges. Whether you want to invest in local ETFs or global ETFs, investing opportunities are

abundant. We even offer a Core Selection of 200 ETFs for which commission costs are on the

house. Currency, external product and spread costs may apply. See the ETF Core Selection,

conditions and fair use policy here. Open a free account and discover the possibilities.

With our low fees and wide trading possibilities, we make investing in ETFs accessible to

everyone. See a complete overview of our unprecedented rates here.

ETFs, also known as trackers, are funds that follow the performance of an index, commodity, bond or composition of products. Unlike some other funds, ETFs are bought and sold on a stock exchange. Would you like to learn more about ETFs? Read our ETF article for all you need to know.

We offer the possibilities and rates of professional parties to private investors. This

makes investing in stocks accessible to everyone.

When a company is in need of liquidity, it can take out a loan with the bank. Another

option is to issue shares (also known as stocks). You invest your money in a specific

company when you buy shares. When a company issues new shares, the company receives the

money that you (and other investors) have invested. The buyer of a share is called a

shareholder. In exchange for your investment, you become a part-owner of that company.

Profits and losses of the company are often reflected in the share. A share is, in fact,

nothing more than a (tradable) proof that you own part of the capital of a company.

Once you know which stocks you want to buy, the next step is to place the order. But how does that work? You can place different types of orders. These order types aim to make trading easier and more targeted.

The most frequently used order is a Limit order. With this order type, you submit the quantity of stocks you want to buy or sell, and the maximum price at which you are willing to carry out the trade. Suppose you want to buy 100 stocks of company ABC. The price at the time is $35 per stock but you are only willing to pay a maximum of $33. In this case, you can place a Limit order for 100 stocks at a price of $33 per stock. If the stock price falls to $33 or below, your order will be eligible for execution at the best available price. So, the main advantage of limit orders is that you always know what the maximum price would be if you are looking to make a purchase. However, it can also be the case that the price never hits $33. Therefore, if you try to make a purchase with a very low limit order, it can take a very long time, or might not be executed at all. The closer you place the order to the current price, the more likely it will be to receive a faster execution.

But there are also more advanced order types, such as the Market order. With this order type, you

submit only the quantity of stocks to be bought or sold. You do not enter a price but rather the

order will be executed at the best available price at that time. Say you place a market order to buy

100 stocks of company ABC. If the price is $35 at the time, and 100 stocks are available for this

amount, your order would go through immediately at a price of $35 per stock.

You can also place an order when the exchange is closed. In this case, the order will be sent to the

market upon reopening. Keep in mind that the price you receive the next day can be different than

the price when you placed the order. For example, if positive news breaks overnight about ABC, the

stock may resume trading the next morning at $40 per stock. In that case, with a market order you

would then buy $4.000 of the stock the following morning. Of course, you can still remove the order

before the market reopens the next morning.

There are also order types that can be used to respond to changes in the market. For example, if you

hold a position of 100 stocks in ABC and wish to protect yourself from a price decrease, you can

place a stoploss order. Say the price is currently $35 per stock and you wish to sell the position

if price drops. You can then place a stoploss order with a stopprice of $30. That way, if the price

falls to $30 or below, your order will then be sent to the exchange as a market order. This order

type is handy if you are unable to monitor the market at all times.

However, you should also consider that it is possible that your order will be executed for less than

$30. Say bad news about ABC breaks outside of market hours, driving the open price to $20 the

following morning. That would mean that your position would be sold as a market order at $20 per

stock.

With our low fees and wide trading possibilities, we make investing in bonds accessible to everyone. Currency, connectivity, or external product and spread costs may apply. Find out more on our fees page.

A bond is a fixed income financial product that allows an investor to lend money to an issuing entity, usually governments or corporations. In return, the buyer of a bond (the lender) typically receives regular payments, called coupons, until the issuer repays the principal, also known as the face value or par value, on the maturity date.

There are many advantages of investing in bonds. Bonds are considered to be a relatively safe investment and they offer regular income payments. They can also help to diversify your portfolio because they have a low correlation with other types of financial products, such as stocks.

If you're an experienced investor and want to invest in futures, our comprehensive platform and low rates makes it easy to do so

Futures are standardised contracts that, like options, are made between two parties at a fixed price and expiry date. It is a contract to deliver an underlying product at an agreed time in the future at an agreed price. Unlike other financial products such as stocks, with futures, you do not pay the full cash amount upfront or own the underlying product. Instead, you deposit initial margin to enter the futures position. Since only a percentage of the contract's value needs to be put up initially, futures are highly leveraged financial instruments. This means that slight price movements can have a large impact. There are different types of futures, depending on the underlying product. Among these are commodity futures, index futures, equity futures and fixed income futures.

Investing in futures can help with risk management and speculation. In terms of risk management, investors can use futures to hedge price movements of the underlying product. On the other hand, speculators can use futures to profit from price movements of the underlying product.

A unique feature of futures is that they are settled daily. At the end of each trading day, the closing market price is determined by the exchange that the future trades on. This is known as the daily mark-to-market (MTM) price, and it is the same for everyone. There are daily mark-to-market settlements until the expiry of the contract or the position is closed out. The payment for a futures contract is made at the end of the agreed term. This can be done by physical delivery or a cash settlement, but cash settlement is more common.

If you are an experienced investor and want to invest in options, our comprehensive platform and low rates makes it easy to do so.

Options are a type of derivative that gives the buyer of the contract the possibility to buy or sell the underlying asset, depending on if it is a call or a put. Buying a call gives you the right to buy the underlying asset, whereas a put gives you the right to sell. For this right, buyers pay a premium to sellers. Options contracts will always have a specific expiration date and exercise price.

Investing in options can help with risk management and speculation. In terms of risk management, investors can use options to hedge price movements of the underlying product. On the other hand, speculators can use options to profit from price movements of the underlying product

If you're an experienced investor and want to invest in futures, our comprehensive platform and low rates makes it easy to do so

We offer investing in a variety of different commodities on our platform. But what is the best choice for you? To get you started in the world of raw materials, we have listed a few categories. Click on them to learn more and discover the most popular raw materials within each category!

The demand for copper has increased significantly in recent years. This demand comes mainly from the construction industry, but a lot of copper is also used in the energy sector and for the production of electric vehicles, solar panels, charging stations and wiring in the power network. As long as the world's population continues to grow, there will be a demand for copper.

At NAVIX FINANCIAL there are several ways to invest in oil. We have a wide range of company shares from the oil industry. In addition, you can also invest in oil-related ETFs and ETCs. Some of these products can be found in our ETF Core Selection, for which commissions are on the house. Currency, external product and spread costs may apply. For advanced investors, it is possible to invest in oil through futures. At NAVIX FINANCIAL, you can invest in futures on a number of affiliated derivatives exchanges. You will find all the futures contracts we offer on our platform under the 'Products' tab when you choose 'Futures'.

Lithium is a silver-gray, soft metal and the lightest metal on earth. It even floats on water! Because of this, it can be put into batteries without weighing them down. This is one of the reasons why lithium batteries are popular in the automotive industry.

At NAVIX FINANCIAL, there are several ways to invest in lithium. We have a wide range of corporate stocks in the lithium industry. Think of companies that produce the raw material lithium, but also companies that make batteries from lithium. In addition, you can invest in ETFs in which lithium-related companies are included. By doing so, you invest in lithium in a diversified way that helps to spread the risk.

Uranium is a metallic gray material. It is mainly extracted in open pit mining or underground tunnels where ore is brought to the surface. It is often found as a by-product in gold or copper mines. There are also ways to extract uranium from the ground by pumping water deep into the ground. Adding oxygen to this water causes uranium to rust. This rusty water is pumped up and uranium is then extracted from it. Investing in uranium through NAVIX FINANCIAL At NAVIX FINANCIAL, you can invest in a wide range of stocks in the uranium industry. Open an account and make the most of your investments with our incredibly low fees

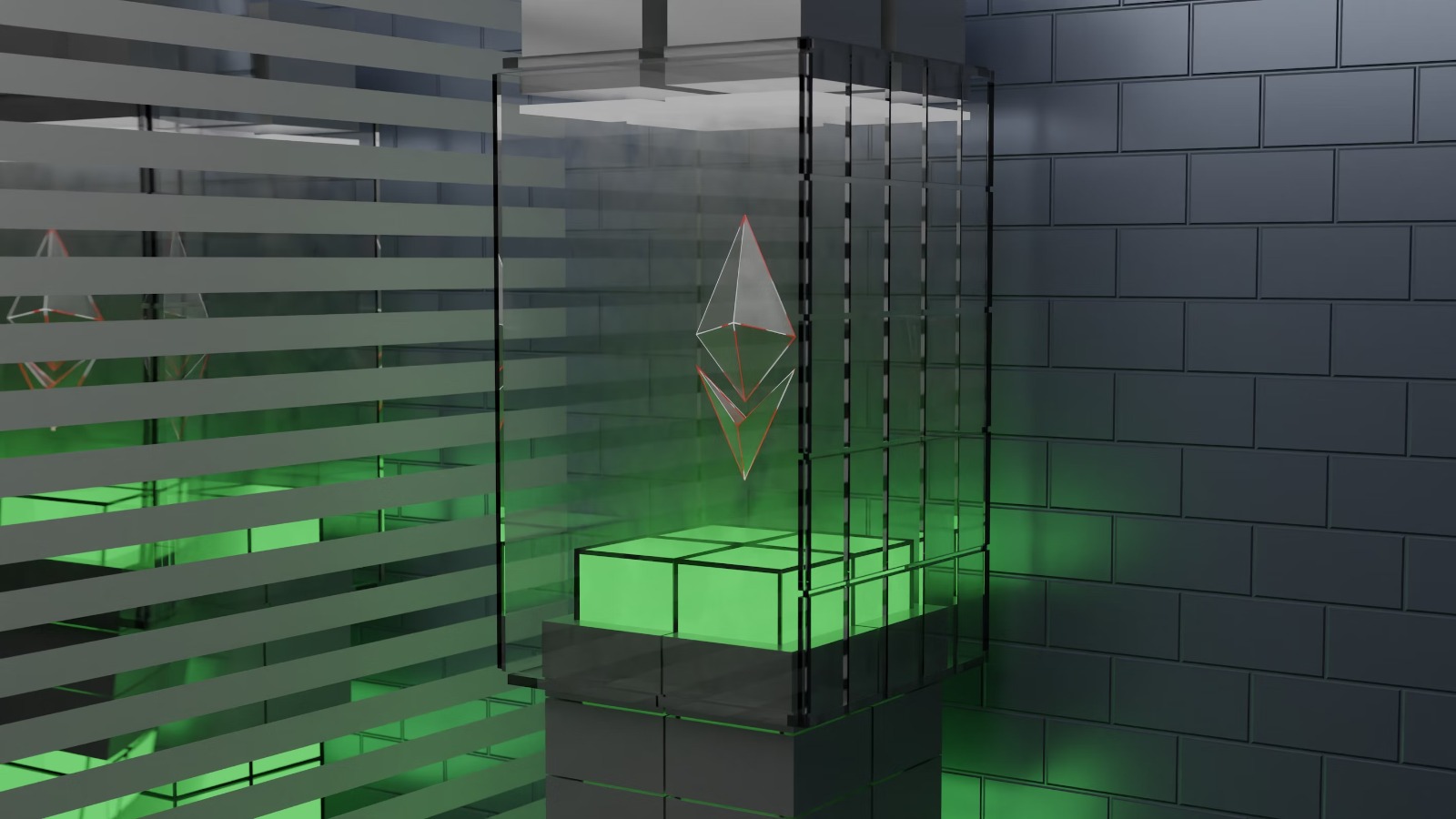

Whether you're looking to speculate on short-term price action or playing the long game, trading crypto with NAVIX FINANCIAL is the secure, flexible and hassle-free way to invest in cryptocurrencies like bitcoin, ethereum, litecoin and many more. Why trade crypto Why trade Crypto CFDs with Pepperstone? * Competitive spreads * Trade Crypto CFDs without the need for a digital wallet * Weekend trading available on Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Ripple, Polkadot, and more * The ability to hedge on a single account * Go long or short on Bitcoin CFD price movements with leverage of up to 2:1 on all of our trading platforms * Trade our range of Crypto CFD markets, including Ethereum and Bitcoin Cash, and global index derivative products – Crypto10, Crypto20 and Crypto30 – that track changes in the value of a basket of the world's most highly traded cryptocurrencies